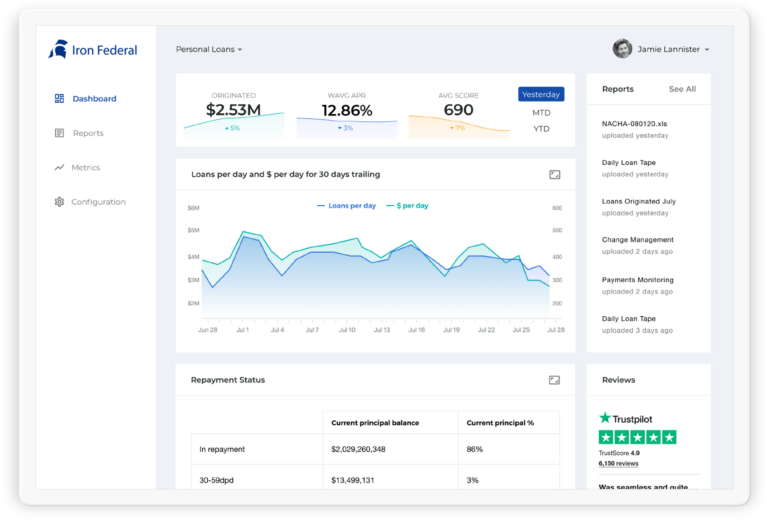

Upstart’s Credit Decision API will enable us to increase the speed of lending decisions, better price applicants and more accurately assess risk, ultimately to better serve our customers.

Indirect auto loans

Expand your share in indirect auto

Leverage Upstart’s AI technology to acquire more loans from your dealers by approving more creditworthy borrowers and improving the dealer experience.