Upstart HELOC offers an easy and fast way to grow volume in a secured asset class and acquire prime members. With an all-digital application process, borrowers can be conditionally approved for a HELOC in minutes, while streamlined automation results in a quick close. Originated by Upstart Mortgage and sold to lending partners, these HELOCs have a minimum 80% draw, leading to high utilization and immediate interest income for your institution.

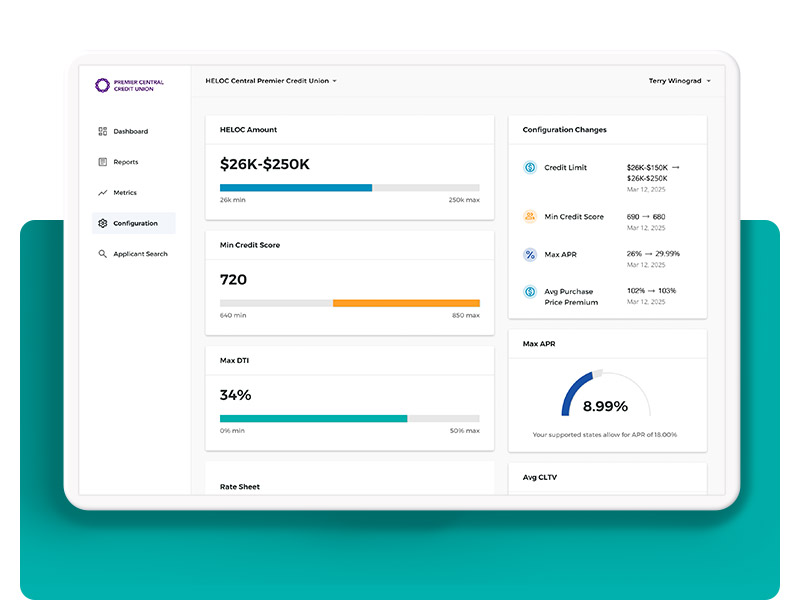

Use your own pricing grid or leverage Upstart’s AI model and set disqualification criteria, based on factors such as credit score, CLTV, DTI, loan amount, property type, and/or state.

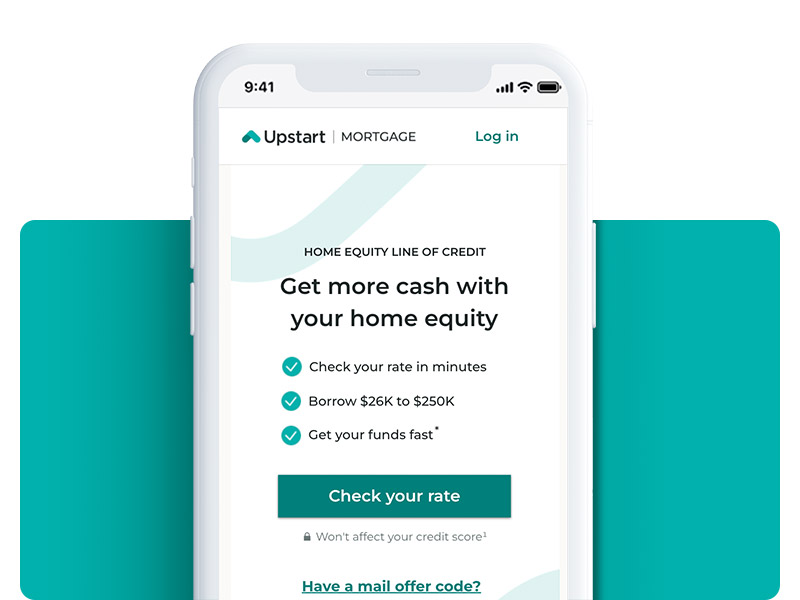

Upstart’s marketing engine uses advanced strategies to drive homeowners to UpstartMortgage.com where they can apply for a HELOC.

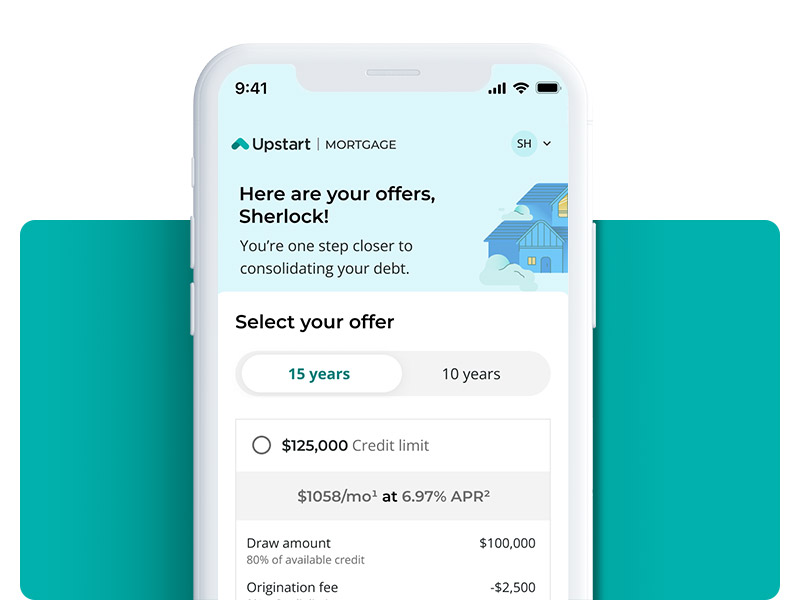

The homeowner receives instant pricing on their line of credit with an 80% minimum initial draw required.

Each HELOC draw is fixed-rate and fully amortized over the remaining term.

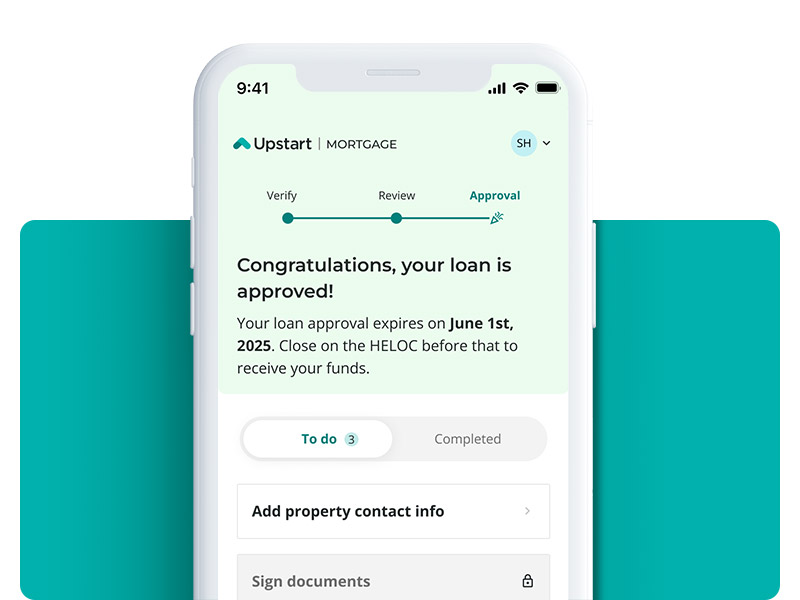

The Upstart HELOC solution includes verification automations such as AVMs, digital lien verifications and Remote Online Notaries to ensure borrower and property information is verified in the application and closing processes.

Lending partners purchase Upstart Mortgage HELOCs and review the credit file and applicable documentation before formally executing the HELOC purchase.

The Upstart family of brands includes Upstart Network, Inc. and Upstart Mortgage LLC. Upstart Network Inc, consists of a marketplace where consumers can connect with lenders for personal loans, auto refinance and other products. All mortgage lending is conducted by Upstart Mortgage, LLC. UML State Licenses. NMLS #2443873. NMLS Consumer Access.

1 Upstart Mortgage offers HELOCs from $26K-$250K. The exact amount you may borrow depends on what you qualify for based on your application information.

2 For HELOCs originated from Jan – Oct 2024.

3 As of January 2025, 10% of funded HELOCs achieved a closing timeline of 5 days or less and a funding timeline of 11 days or less. This timeline assumes consumers close with our remote online notary, provide supporting documentation promptly, and ensure the information provided is accurate and consistent with our verification process. Delays, discrepancies, and other unforeseen factors may impact the closing timeline.