Auto Retail Lending

Accelerate loan growth through connected auto retail

Auto Retail Lending gives your institution direct and easy access to auto loans originated at Upstart-powered dealerships without the complexity of indirect lending.

Auto Retail Lending gives your institution direct and easy access to auto loans originated at Upstart-powered dealerships without the complexity of indirect lending.

Indirect auto lending has long been a tough channel to grow due to competition and high operational expenses. With consumer expectations changing, lenders and dealerships must improve the digital car buying and financing process or they risk losing market share.

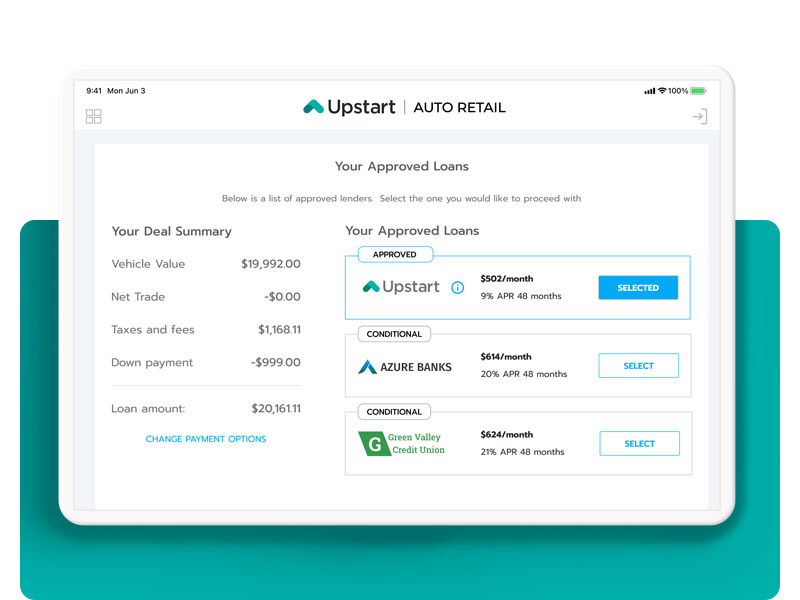

Upstart can help your institution win more auto loans with immediate access to a large dealer network of Upstart-powered dealerships. Unlike indirect auto lending, with Upstart, you can increase conversion rates by automatically bidding on more loans at the dealer and grow your auto portfolio with minimal resources.

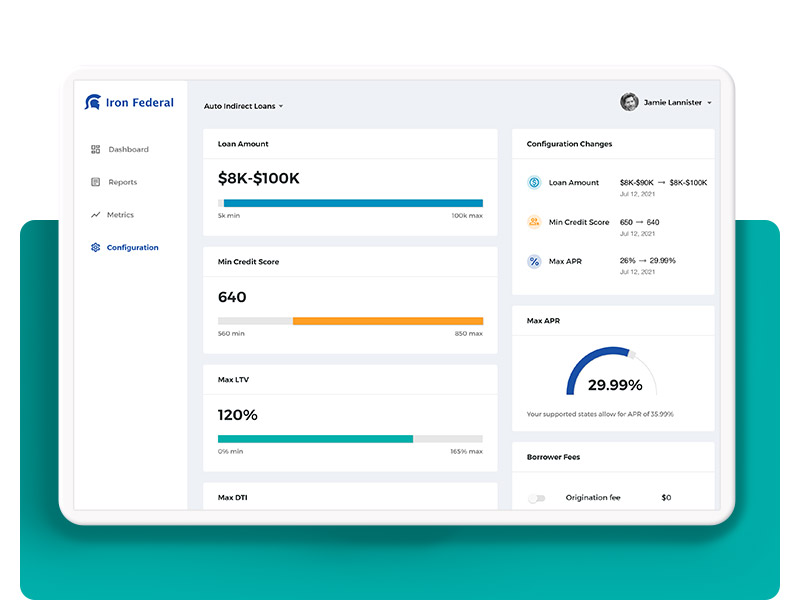

Have full control over your credit parameters and risk profile to achieve your target auto loan volume and returns.

Your financial institution is automatically connected to customers at Upstart-powered dealerships — minimizing the need to proactively build a dealer network.

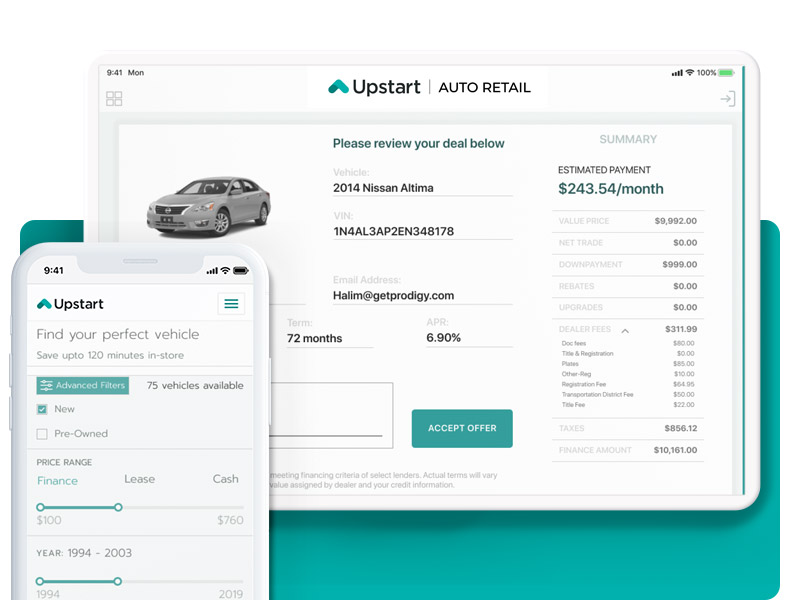

Customers can shop, configure the deal, and submit for financing online—without a hard inquiry on their credit.¹

Upstart seamlessly integrates with existing F&I solutions and requires minimal setup to get started.

Dealerships instantly receive a credit decision for every deal submitted through the platform — increasing your look-to-book and helping you gain more share of the indirect auto market.²

Upstart’s risk-based AI model individually prices the deal within your credit criteria and allocates the loan to your institution.

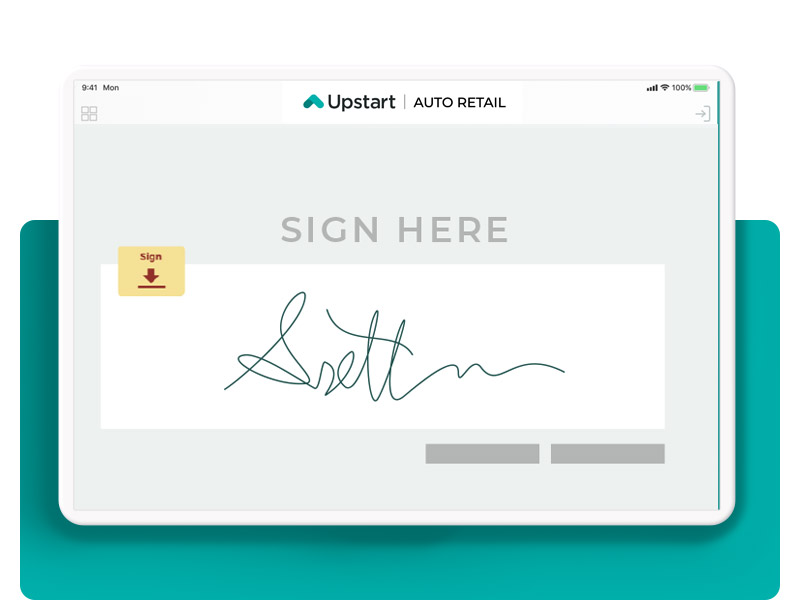

Customer identity and income are verified within the Upstart Auto Retail platform with most borrowers being instantly approved.

If required, documents and stips can be easily uploaded through a mobile-friendly process—with all verifications handled by Upstart.

Upstart purchases all contracts with the dealer directly and will forward-flow loans based on your target return and credit parameters.

Discover how Upstart Auto Retail is changing the way consumers shop and finance their cars online or in-store through a next-generation digital retail platform.

Learn how to get started using Upstart’s AI technology so you can grow your auto loan portfolio — and gain that competitive advantage.