By expanding our partnership with Upstart into auto refinance, we're able to extend lending services beyond our local footprint and serve more creditworthy borrowers which aligns with our goal of helping all families build a better financial future.

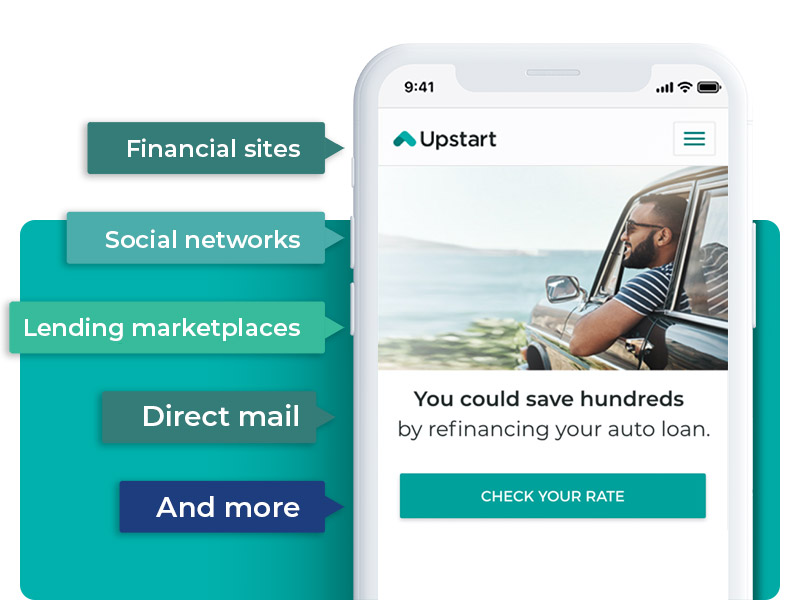

Upstart Referral Network

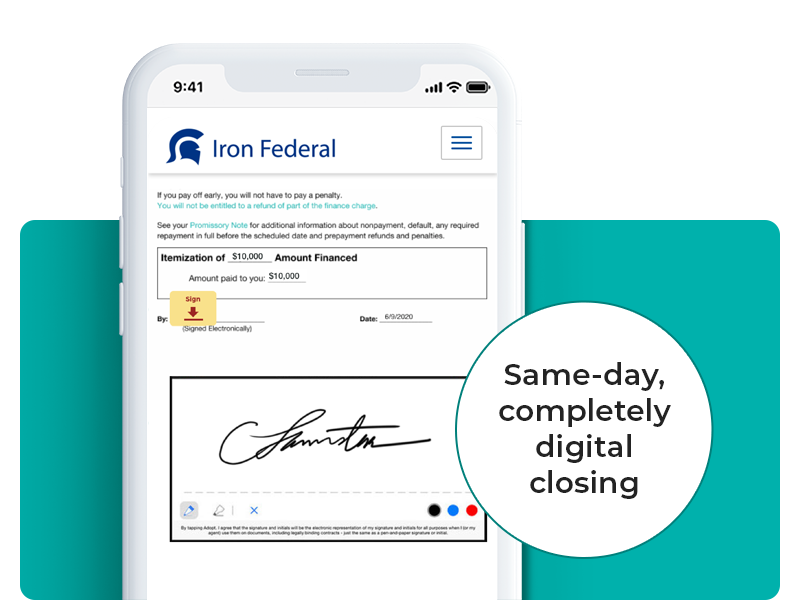

Acquire new auto refinance loans and customers quickly

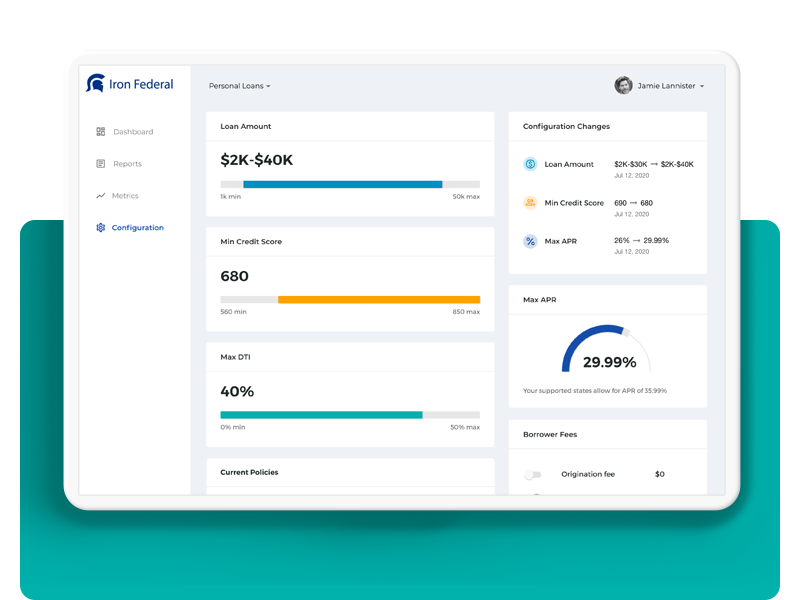

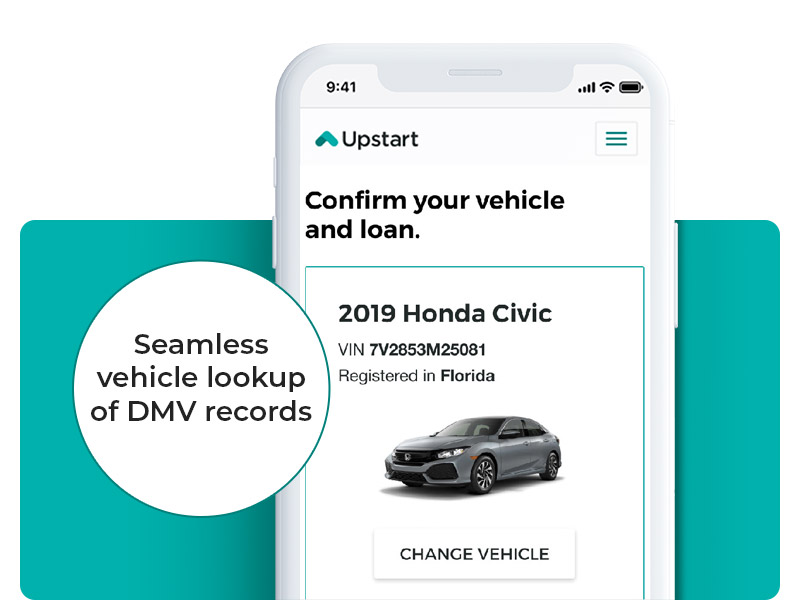

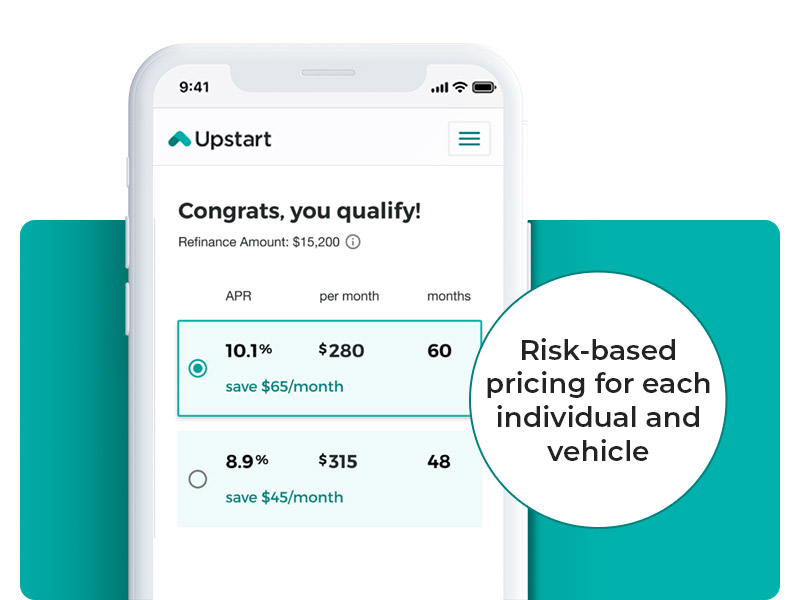

Upstart drives refinance-eligible borrowers to Upstart.com and provides your institution with auto loans that meet your credit criteria.