Through our partnership with Upstart to power both personal loans and auto refinance loans, Firelands FCU will accelerate our digital transformation initiative by offering our members a modern, all-digital lending experience. With Upstart’s AI lending platform, we will be able to say yes to more creditworthy members while lending more inclusively across the communities we serve.

Auto refinance loans

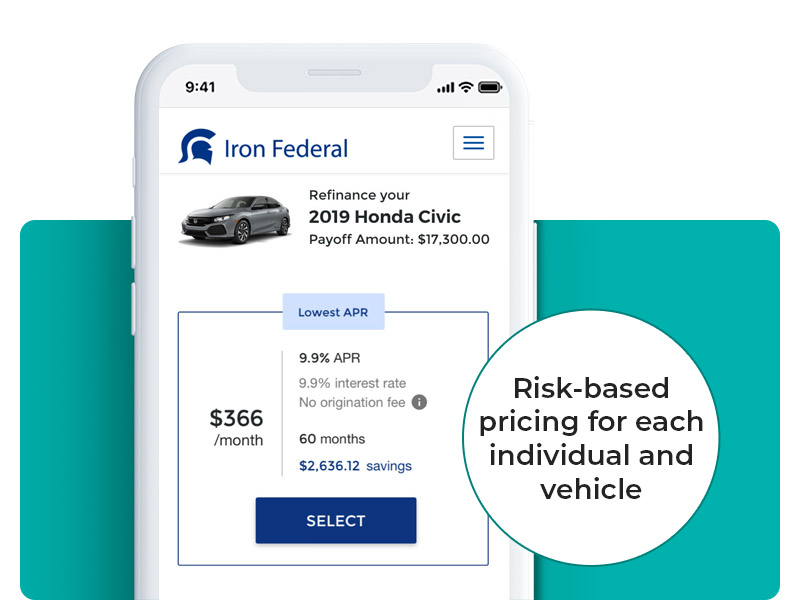

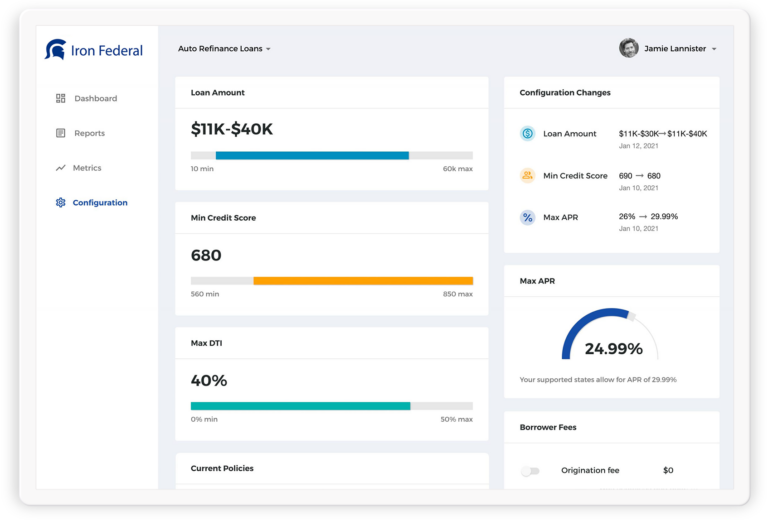

Accelerate auto lending through AI

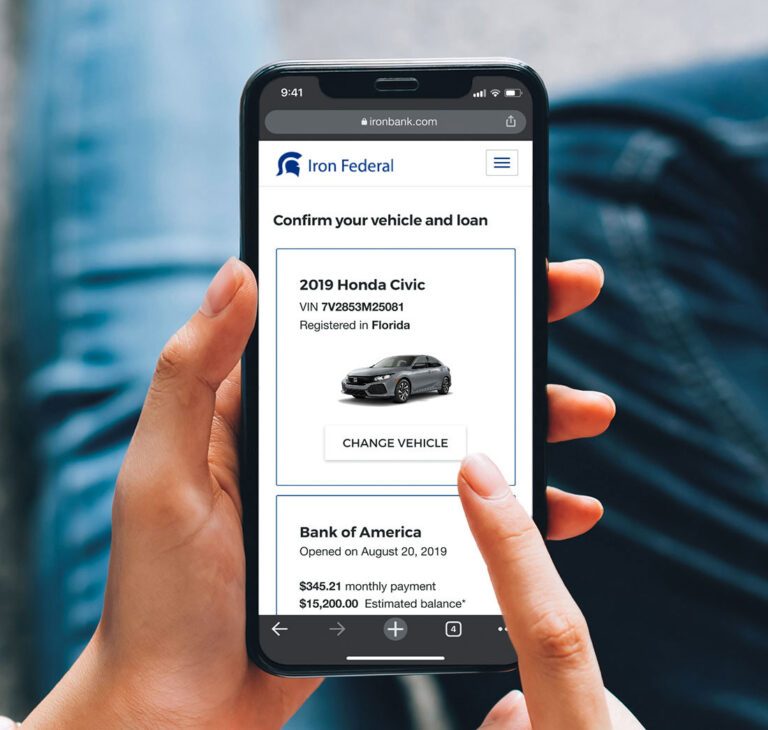

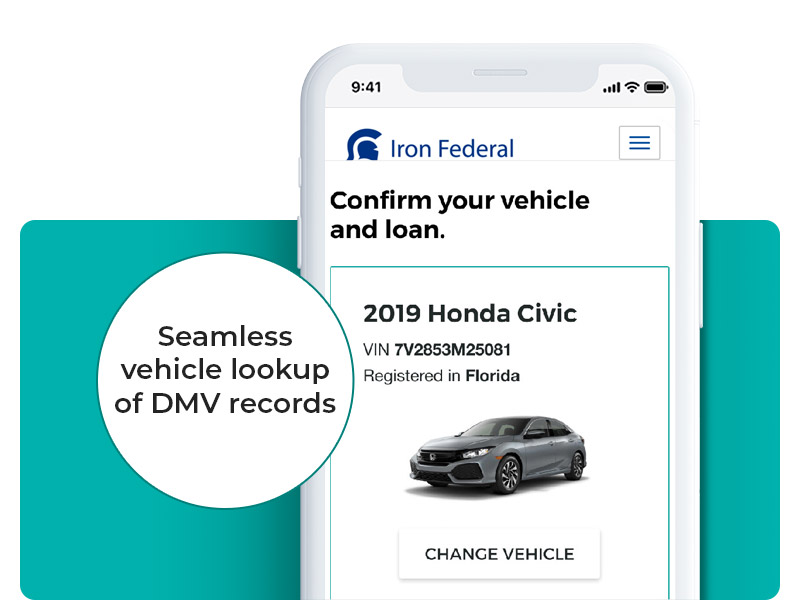

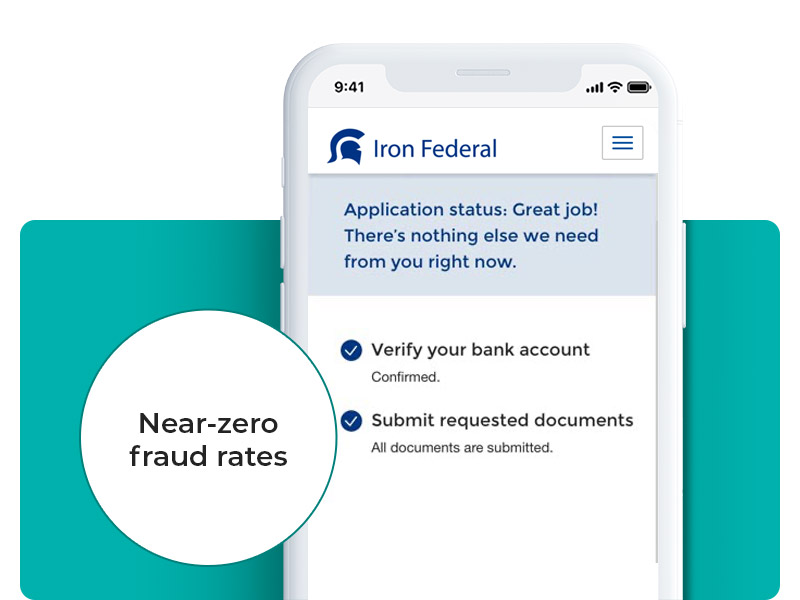

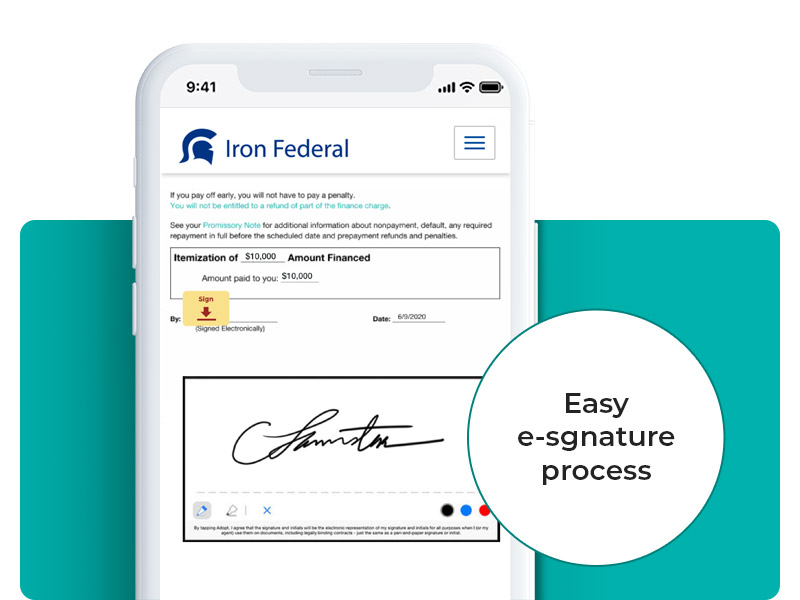

Deploy Upstart’s Lender-Branded Platform on your institution’s website to offer a frictionless, digital auto refinance experience.