2023 Credit Union

Auto Lending Outlook

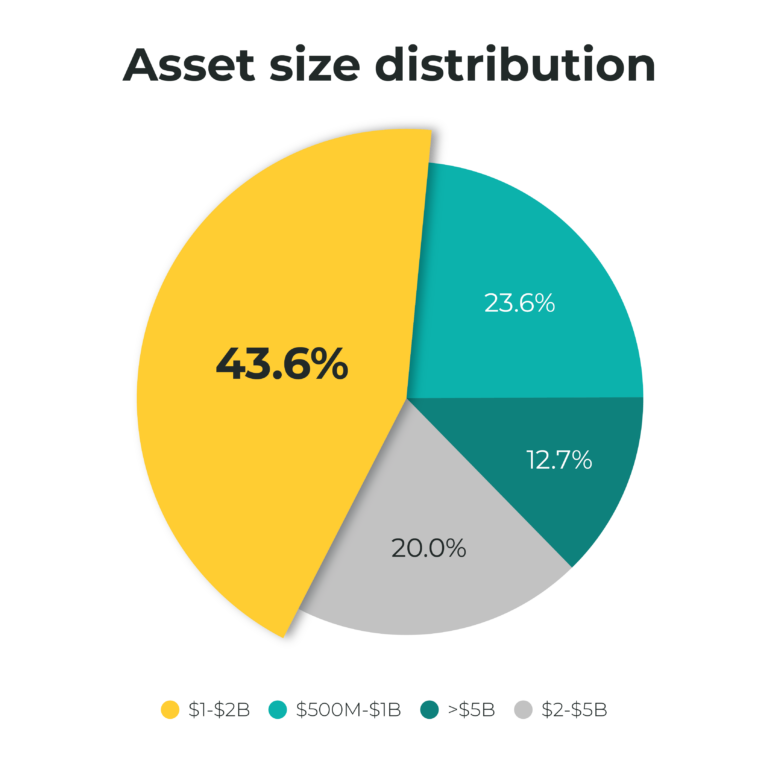

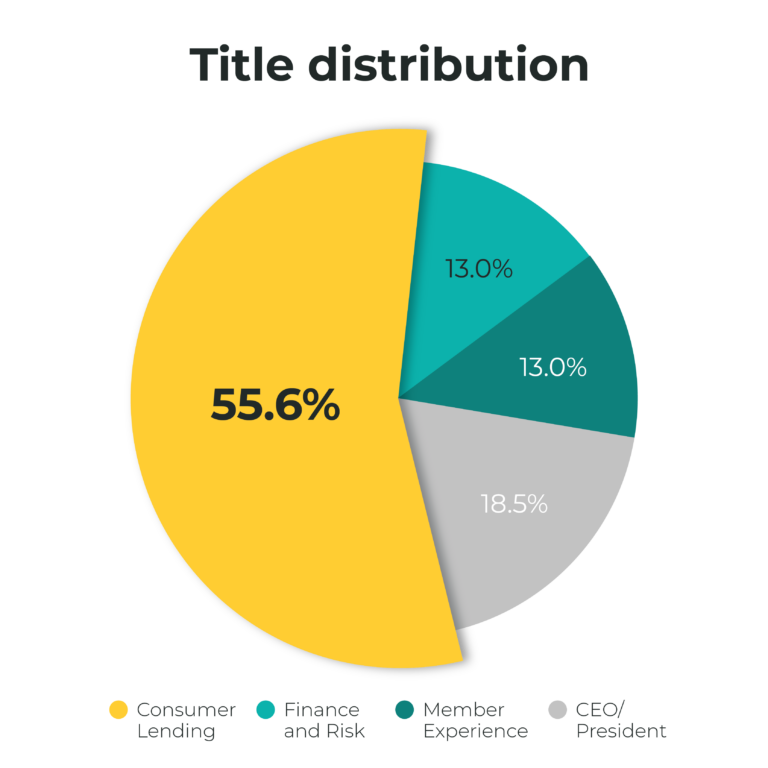

Upstart compiled responses from 55 credit union executives to uncover their growth strategy and pain points in auto lending for 2023

Upstart compiled responses from 55 credit union executives to uncover their growth strategy and pain points in auto lending for 2023

The survey was conducted between November 3 through November 18, 2022 and assesses credit union leaders’ perspectives on auto lending — including direct, indirect and refinance. The questions focus on current pain points, the difficulty of existing processes in the various types of auto lending and areas of strategic focus in 2023. Credit union leaders responded to between eight and fifteen questions, depending on their auto lending product offerings, to assess the difficulty of certain aspects of the auto lending process today, as well as credit unions’ perspective on what process improvements would make the largest impact to their business.