For the past few years, automotive retail has gone on a rollercoaster ride. After the pandemic recession, dealers that embraced no-contact digital sales rode a strong wave of demand into 2021 and 2022. But as 2022 comes to a close and all eyes are on ‘23, the gravy train of high demand, prices, earnings, and employee retention is putting on the brakes.

Although inventory shortages have eased up, production slowdowns are predicted to continue in 2023. But low inventory seems like the new normal—our eyes are on other challenges in 2023.

From industry sources and Upstart Auto Retail’s own auto retail experts, 2023 predictions include:

- Falling consumer demand and difficult financing

- Return of MSRP and OEM incentives

- Renewed focus on customer experience

- Online car buying and digital F&I

- Falling employee earnings and rising turnover

All in all, signs point to a tougher year ahead for dealerships. But advancements in dealer technology and a focus on efficiency can make these challenges easier to overcome.

Consumer demand falls while financing gets trickier

While demand for cars was on fire throughout 2021 and 2022, inflation and rising interest rates are already tampering demand. And with more tightening of the economy predicted in 2023, car-buying budgets and enthusiasm will likely fall. Deloitte says 37% of American households are in worse financial standing than a year before.

“Interest rates affect affordability,” says Jack Marcinkewicz, Manager of Dealer Success at Upstart Auto Retail. “Even for prime borrowers—it’s much less appealing to buy a new $60,000 vehicle at a 7% rate.”

At the same time, lenders are getting pickier with loan approvals. Rates at record highs mean financing is more expensive, pushing vehicles out of reach for many customers.

“Some buyers are having problems getting approved for the car they want,” explains Fiona Santoianni, Sr. Dealer Success Manager at Upstart Auto Retail. “It’s eye-opening to see what dealers have to go through lately to get customers with good credit approved at an acceptable interest rate.”

Many would-be car buyers will focus instead on making their current vehicle last longer, predicts Joe Karnes, Solutions Engineer at Upstart Auto Retail. While that may support your service department, it means fewer trade-ins and new sales.

MSRPs replace markups while OEM incentives reappear

After a long hiatus, MSRPs and OEM incentives are back in action.

After a long hiatus, MSRPs and OEM incentives are back in action.

“We’re already starting to see more captive lenders offering low rates, even 0% in some cases, to clear out ‘22 models and counteract the high-interest environment that keeps customers away,” predicts Marcinkewicz. He also adds that, “markups are disappearing even on the fastest-selling models.”

And Santoianni agrees: “I’m seeing a lot of dealers remove markups and even sell below MSRP.” While steep discounts aren’t likely, industry analysts predict the blend of pricing, incentives, and sales to come back down near pre-pandemic levels. Powers throughout the industry will try and make up for the challenges as they try to attract weary customers.

“Rising rates, tougher approvals, and economic headwinds are putting pressure on manufacturers to get creative,” explains Charles Rowe, Sr. Dealer Success Manager at Upstart Auto Retail.

Will lower prices and more incentives help prop up decreasing demand? JP Morgan predicts lower F&I profits in 2023, but that could be offset by higher sales volumes. Time will tell. But there’s another aspect to consider as buyers are no longer beating down the door: better customer experiences.

Customer experience is king, again

With inventory rising and prices dropping, customers have more power to shop around for the best deal. But if financing is tough and prices settle around MSRP, how does a dealer stand out? Customer experience. It’s time to focus on building relationships and work harder to earn customers’ business and loyalty.

2023’s car buyers won’t be at the mercy of inventory availability like 2022’s buyers were. With more choice, they’re going to be more influenced by their engagements throughout the buying journey. Much of that will happen online, yet plenty of customers are still valuing in-person dealership experiences.

But they’re not looking to revert to the inefficient showroom experiences of the past. Rather, they want to place their trust in their salesperson and enjoy smoother, faster transactions plus a higher level of hospitality and transparency.

“A lot of dealers are taking on the role of a guide or concierge, especially as so much of the heavy lifting can be done online by the customer,” Santoianni says.

Rowe puts it simply: “customer experience is king.” Providing transparency online and in-store, saving time at every stage, and picking up where the customer left off online—without redundancy—all compound to better customer experiences.

Finding affordability

2023’s customers will likely have more trouble balancing the model they want with the payment they can manage. Crucial to positive customer experience are sales teams that can guide customers into affordable options. Transparency goes hand-in-hand here, too—making sure customers see, understand, and are happy with every item within their total price and payments.

“Customers who bought when prices peaked might now need lower payments,” Marcinkewicz adds, “but when they come back in to find out they have lower buying power or are deeply underwater, they’re not going to be happy customers.”

“Sales needs to help customers do the right thing,” says Karnes. “They’ll have to help address financial concerns and transparently, empathetically guide customers into different terms—and even different vehicles—that better suit their budget.”

He points out that happy customers tend to be loyal customers, coming back for service and additional sales.

Luckily, other rising trends in auto retail can improve customer experience and bring confidence and transparency to the financing conversation.

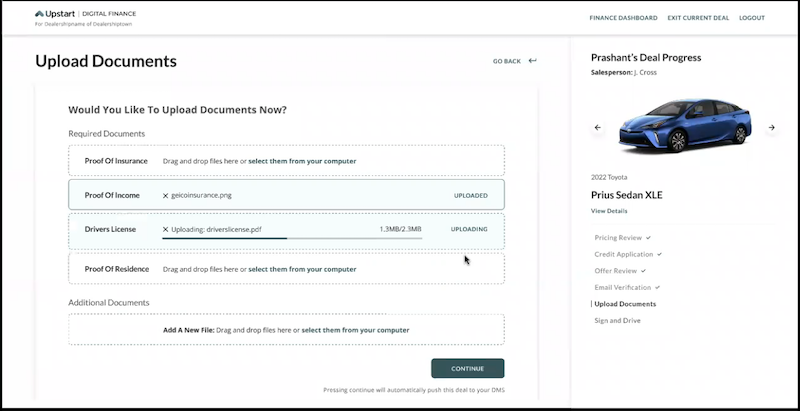

Accelerated rollout of online car buying and digital F&I

The overall retail sector is rapidly embracing hybrid shopping experiences that seamlessly combine online and in-store. To stand out and excel in 2023, automotive retailers can take inspiration from successful retail and tech companies scaling fast thanks to online transactions.

Will 2023 be the year online car buying becomes the norm? Automotive ecommerce is quickly becoming the go-to digital transformation—and core shopping experience—for thriving dealerships.

And it’s not just building, comparing, and pricing models, either. Customers want to complete most, if not all, of their transactions online. Market research shows that digital F&I systems are crucial for today’s car transactions, especially as OEMs and auto marketplace startups deploy their own competing solutions.

Upstart Auto Retail Solutions Engineer Shawn Costa has a clear perspective on the matter. “One of the best and most reliable investments in 2023 is your website and online car-buying capabilities,” he says. “Digital auto retail gives consumers the easy online experiences they want, they make your dealership more efficient, and they enable faster, lower-touch sales.”

Real dealership results support the connection between digital retail and faster sales, happier customers, higher-performing employees. “The new way of putting customers first has significantly improved our CSI levels,” says Tyler Degele, Sales Manager at Power Kia.

Digitization and automation mean efficiency

Auto retail expert Brian Pasch highlights another valuable benefit of online car-buying tools and digital F&I processes: efficiency that can reduce overhead costs.

He advises dealerships to focus on “automation solutions to remove mundane tasks from their staff and thereby, reduce labor costs.” That means “dealers must accelerate investments that create a frictionless sales and service experience.”

Pasch goes on to explain how providing tools like digital retail is “amazingly efficient and profitable for the dealer.” At the same time “employee turnover is dramatically reduced,” which could be a saving grace when it comes to this final 2023 prediction.

Sales team earnings decline and turnover rises

Recently, dealership employee earnings topped out while turnover dropped to record lows—but 2023 will likely see those trends reversing. So you can expect it to be harder to pay, retain, and recruit employees as the auto market cools off.

Sales teams will also face more pressure from managers and OEMs to sell more, as demand drops and inventory rises. Instead of cars selling before they even hit the lot, salespeople will have to put in more effort and for less payout. That can be especially problematic for newer salespeople brought into the industry during the past couple years of easy closes. Forward-thinking managers can look to hiring and retention tips to keep the best people around. They can also consider restructuring and retraining to embrace some of the most crucial roles in today’s digital-first dealerships.

To survive and thrive, dealers will need to be more effective with less while investing in their websites, online marketing, and digital car-buying tools, Costa believes.