Retirement planning is an important part of life, especially since Americans are living an average of 30 years longer than a century ago. This, coupled with Americans not being able to save and invest properly may be troublesome for many when they reach their golden years.

According to one study, 47 percent of Americans still aren’t investing or planning for retirement. A common reason people said they weren’t planning for retirement was because of a lack of money or knowledge about investing.

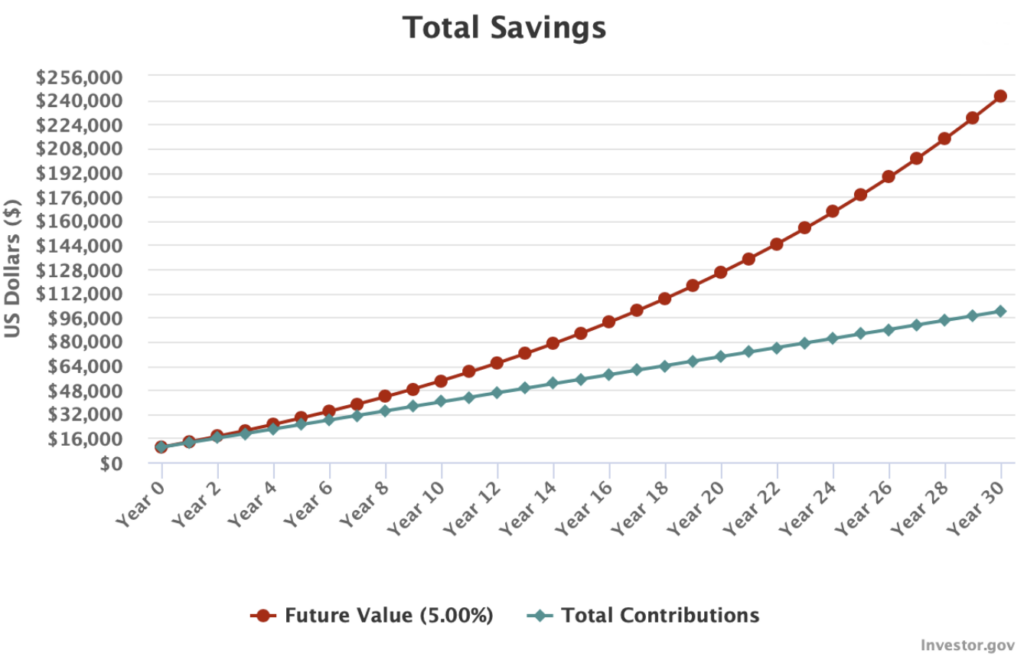

Whatever the reason people aren’t investing, each day that goes by means a loss in compound interest—which is one of the perks of putting money away for the long-term. The best strategy to put in place is to start early and allow the power of compound interest to let your money make you more money.

What is compound interest?

Compound interest is the interest you earn from the original amount you deposit, known as the principal amount, plus the interest you continuously earn on from your initial interest. Think of it as a snowball effect, where you consistently make money on the interest as the years go by, making your pot of money bigger.

Calculating compound interest involves taking the total principal and future value of your interest, minus the current, principal amount.

Compound interest:

= [P (1 + i)n] – P

= P [(1 + i)n – 1]

If you’d rather use an online calculator, this is what you may see for the following investing scenario:

- Principal amount invested: $10,000

- Interest: 5%

- Monthly contribution: $250

- Compound interest over 30 years

- Total amount after 30 years: $242,535.97

As you can see, the snowball effect of compounding can be quite powerful and earn you significantly more over the years. This is because compounding interest gives you gains on your gains, and so on.

Every year, the amount of interest is added on top of the initial money you’ve saved, plus the previous year’s interest, which calculates to a higher earning each year. This helps grow your money and is the reason why financial experts always recommend saving for retirement in your 20s, if you can.

Investing for the long-term means you need to understand that the value of your investments will go up and down with the market, over time. Even if your portfolio isn’t performing as well as you’d hoped, don’t worry. As history has shown, The S&P 500 index, used as a benchmark of the American stock market performance, has returned a historic annualized average return of around 10% since its inception through 2019.

How and when to start planning your retirement

Everyone’s lifestyles, incomes, and goals are different. These days, the FIRE movement has prompted 30-somethings to invest wisely and strategically in order to retire in their 40s or sooner.

No two individuals are alike, so it’s important to think about your quality of life at retirement and when it would be realistic to retire.

On your own, however, consider the following factors, then try to write these down so you have a jumping off point, should you decide to speak with a professional:

- In how many years would you like to retire?

- What kinds of assets do you currently have (a house, other stocks, etc.)

- What kind of lifestyle would you like to live in retirement? (i.e., Do you envision yourself traveling a lot or staying home to take care of family and grandkids?)

- How much would you comfortably need in order to retire?

What to factor when estimating how much you’ll need in retirement

There are important financial factors to take into consideration when doing the math for retirement. It’s planning for a whole new chapter of your life that may look very different than where you are now. You’ll have to estimate and examine your lifestyle, spending habits, and what you foresee for the future.

For example, maybe you want to retire in a completely new state with a warmer climate, like Hawaii or Florida. This means you need to understand what taxes you’d be responsible for paying for a property or income.

Here’s what you should think about when planning for retirement:

- Expenses: Calculate how much you need on a monthly basis to live. These include utilities, groceries, gas, mortgage payments, and credit card bills. Some expenses will change or be eliminated all together, such as childcare costs or even grocery bills. If you have kids, they will be grown and out of the house, so those spending categories will be nonexistent. However, maybe you want to travel more during retirement, so in that case, estimate how much you’d need for that. Don’t forget to account for inflation.

- Investment risk: Do you tend to play it safe or invest more aggressively? Retirement planning requires you to invest in an index fund where you can allocate a portion to mutual funds, stocks, bonds, and ETFs.

- Retirement age: Knowing this number, plus your appetite for risk can help you better understand how to diversify your investments in your index fund.

- Taxes: If you know you’ll receive a pension, look for specific tax exemptions or credits in the state you want to retire in.

- Housing costs: If you plan on moving or purchasing a new home (or downsizing to a smaller one), think about costs related to that, including homeowners insurance and property taxes, as well as home improvements, and maintenance costs such as yard work and repairs. Or perhaps you know by the time you retire that your home will be paid off—this will free up your retirement budget so you can use that money for other things.

- Healthcare costs: This might be difficult to estimate especially if you’re still relatively young and healthy, but consider the costs for treatments when you’re older or if you have a specific condition that may worsen with age. There’s also the cost of assisted living care and nursing home services to consider as well.

- Income during retirement: Just because you retire doesn’t mean you won’t have any income. Depending on what kind of work you do, you could potentially continue working part-time or take on a seasonal job to supplement your income.

The different types of retirement plans

The best way to ensure diversification and a solid growth of your retirement funds is to use a mix of different types of funds.

These are the various long-term investment retirement accounts you can use. Within these accounts, you’ll have options for the types of investment vehicles, such as mutual funds or index funds, which is a diversified portfolio of stocks and other bonds.

The slight difference is that index funds invest in specific stocks tied to the market index while mutual funds refer to a broad class of investment funds that follow a specific strategy for investing. For example, when you near retirement age, a mutual fund will shift more of your investments from stocks to bonds.

-

Traditional 401(k)

A 401(k) is only offered to you by your employer and in 2021, you can contribute up to $19,500, with catch-up contributions of $6,500 if you’re 50 and older. The funds are automatically taken from your paycheck and the pre-tax dollars are deposited into your 401(k). This means you are not taxed when you contribute. When you retire and decide to withdraw the funds, you will be taxed at that time.

The nice thing about a 401(k) plan is that your employer may offer a match of a certain percentage, such as 3 percent, for example. This is essentially free money and you should take advantage of that by contributing as much as possible or maxing out your contributions. Even if your employer doesn’t offer this, it’s still worth it to contribute.

-

Roth IRA

A Roth IRA is an individual retirement account in which you can save after-tax income of $6,000 per year. If you’re 50 and older you can contribute up to $7,000.

If you have both a 401(k) and Roth IRA, you can save up to $25,500 each year, or $33,000 if you’re over the age of 50.

The earnings on a Roth IRA are tax-free and withdrawals are also tax-free, as long as you make the withdrawals after the age of 59 ½.

-

Traditional IRA

This is slightly different from a Roth IRA, as your earnings grow tax-deferred until you withdraw them when you retire. Traditional IRAs also qualify for deductions on your tax returns.

Deciding on a Traditional vs. Roth IRA depends on your retirement situation. Some investors believe they’ll be in a lower tax bracket when they retire, so paying taxes on a Traditional IRA may be less than paying when they are in the process of earning them.

Build your net worth for your retirement

Creating a lifestyle that is comfortable and secure in your retirement years is important, so set yourself up for success and consider looking beyond just your retirement accounts to build your overall net worth.

Improving your net worth starts now. Consider the following moves:

- Pay off consumer debt and embrace a lifestyle of spending less and saving more

- Max out your retirement contributions

- Talk to a financial professional to work out all of the details and gain a better understanding of your overall finances

Even if you think you don’t have enough to save for retirement or feel discouraged because you started saving too late, now is the time to figure out your goals and how you want to live your life as you plan for retirement.

Won't affect your credit score¹

Won't affect your credit score¹